Tutorial Questions on Managerial Accounting

Title: Tutorial Questions on Managerial Accounting

Question 2 – Week 3 (7 marks)

Tik Tok Company manufactures customized coffee tables. The following relates to Job No. X10, an order for 150 coffee tables:

Direct materials used $22 800

Direct labour hours worked 600

Direct labour rate per hour $16.00

Machine hours used 400

Applied factory overhead rate per machine hour $30.00

Required:

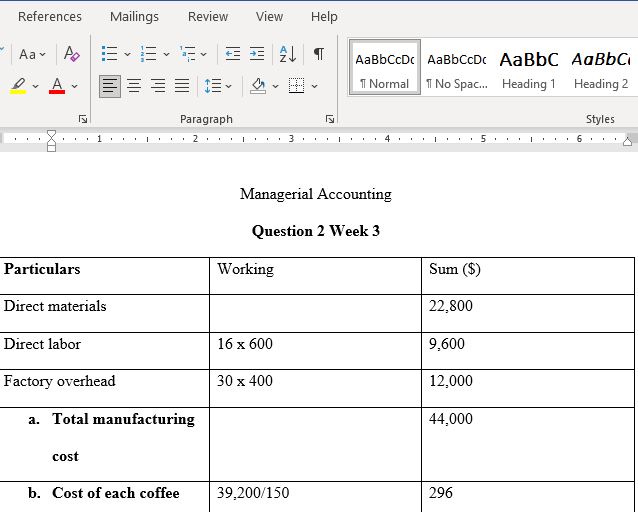

a) What is the total manufacturing cost for Job No. X10? (3 marks)

b) Calculate the cost per coffee table for Job No. X10? (2 marks)

c) List two uses of this unit cost information to the managers at Tik Tok Company. (2 marks)

SHOW YOUR WORKING

Question 2 – Week 5 (11 marks)

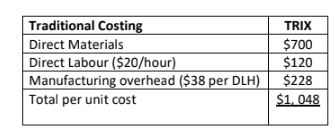

TikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows:

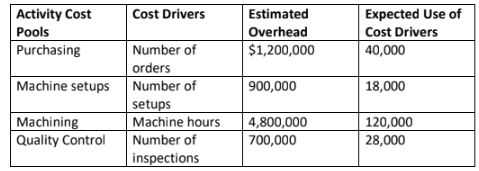

In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare an 3 analysis using activity-based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019.

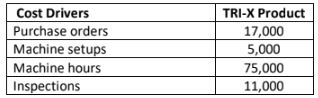

The cost drivers used:

Required:

1. Calculate the activity rates for each of the overhead items using the four cost drivers. (3 marks)

2. Using the rates in (1) determine the unit cost for TRI-X. (4 marks)

3. Calculate the gross profit of each model of TRI-X based on ABC costings and recommend whether or not TRI-X should be discontinued. (4 marks)

SHOW YOUR WORKING

Question 3 – Week 6 (11 marks)

A new company, is being established to manufacture and sell an electronic tracking device: the Trackit. The owners are excited about the future profits that the business will generate. They have forecast that sales will grow to 2,600 Trackits per month within five months and will be at that level for the remainder of the first year.

The owners will invest a total of $250,000 in cash on the first day of operations (that is the first day of July). They will also transfer non-current assets into the company.

Extracts from the company’s business plan are shown below.

Sales

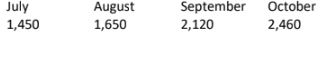

The forecast sales for the first five months are:

Month Trackits (units)

July 1,000

August 1,500

September 2,000

October 2,400

November 2,600

The selling price has been set at $140 per Trackit.

Sales receipts

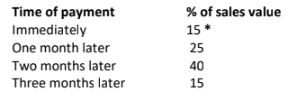

Sales will be mainly through large retail outlets. The pattern for the receipt of payment is expected to be as follows:

Production

The budget production volumes in units are:

Variable production cost

The budgeted variable production cost is $90 per unit, comprising:

$

Direct materials 60

Direct labour 10

Variable production overheads 20

Total variable cost 90

Direct materials: Payment for purchases will be made in the month following receipt of materials. There will be no opening inventory of materials in July. It will be company policy to hold inventory at the end of each month equal to 20% of the following month’s production requirements.

Direct labour will be paid in the month in which the production occurs. Variable production overheads: 65% will be paid in the month in which production occurs and the remainder will be paid one month later.

Fixed overhead costs

Fixed overheads are estimated at $840,000 per annum and are expected to be incurred in equal amounts each month. 60% of the fixed overhead costs will be paid in the month in which they are incurred and 15% in the following month. The balance represents depreciation

Required:

a) Prepare a cash receipts budget schedule for each of the first three months (July – September), including the total receipts per month. (3 marks)

b) Prepare a material purchases budget schedule for each of the first three months (July – September), including the total purchases per month. (4 marks)

c) Prepare a cash budget for the month of July. Include the owners’ cash contributions (4 marks)

SHOW YOUR WORKING

Question 2 – Week 8 (7 marks)

Perfumes Ltd has two divisions: the Perfume Division and the Bottle Division. The company is decentralised and each division is evaluated as a profit centre. The Bottle Division produces bottles that can be used by the Perfume Division. The Bottle Division’s variable manufacturing cost per unit is $3.00 and shipping costs are $0.20 per unit. The Bottle Division’s external sales price is $4.00 per unit. No shipping costs are incurred on sales to the Perfume Division. The Perfume Division can purchase similar bottles in the external market for $3.50. The Bottle Division has sufficient capacity to meet all external market demands in addition to meeting the demands of the Perfume Division.

Required:

a) Using the general rule, determine the minimum transfer price. (2 marks)

b) Assume the Bottle Division has no excess capacity and can sell everything produced externally. Would the transfer price change? (2 marks)

c) Assume the Bottle Division has no excess capacity and can sell everything produced externally. What is the maximum amount Perfume Division would be willing to pay for the bottles? (2 marks)

d) When is it more appropriate to use market-based transfer price rather than cost-based transfer price? (1 mark)

SHOW YOUR WORKING

Answer Preview For Tutorial Questions on Managerial Accounting

Access the full answer containing 449 words by clicking the below purchase button